OWNER FAQS

Answers to your frequently asked questions

-

Why Not to Advertise Your Home for Sale and Rent Simultaneously

watch videotext answerPropM here! If you're planning to advertise your home for both sale and rent, here's why we don't recommend it. When you list your property on third-party sites, the "for sale" ad tends to take priority. This means your rental listing might not get the attention it deserves. And let's be honest—tenants are wary of renting a home that's also for sale. They worry they might have to move out soon if the property gets sold.

Bottom line? Focusing on one clear goal, either selling or renting, will get you better results. At PropM, we specialize in maximizing your rental potential. Stick with a rental plan, and watch how we fill up your vacancies with ease! Got any questions? Feel free to contact us. Until next time, happy renting with PropM!

-

Selling Your Occupied Home? Don't Worry About the Mess!

watch videotext answerFeeling concerned about selling your home with tenants? You’re not alone! Here’s what you need to know:

At PropM Inc., we understand that selling a home with tenants can feel a bit tricky, but don’t worry—it’s often simpler than it seems. If your home didn’t exactly sparkle during the inspection, there’s still time for tenants to tidy things up! Tenants usually clean up before they move out, and if they don’t, their security deposit can cover cleaning and repairs. They can even hire professionals to handle it.

So, remember, you’re not stuck! We’re here to support you every step of the way. Take a deep breath—let’s get that home sold!

PropM Inc.—turning your property worries into wins.

-

What Happens When My Tenant Does Not Pay Rent?

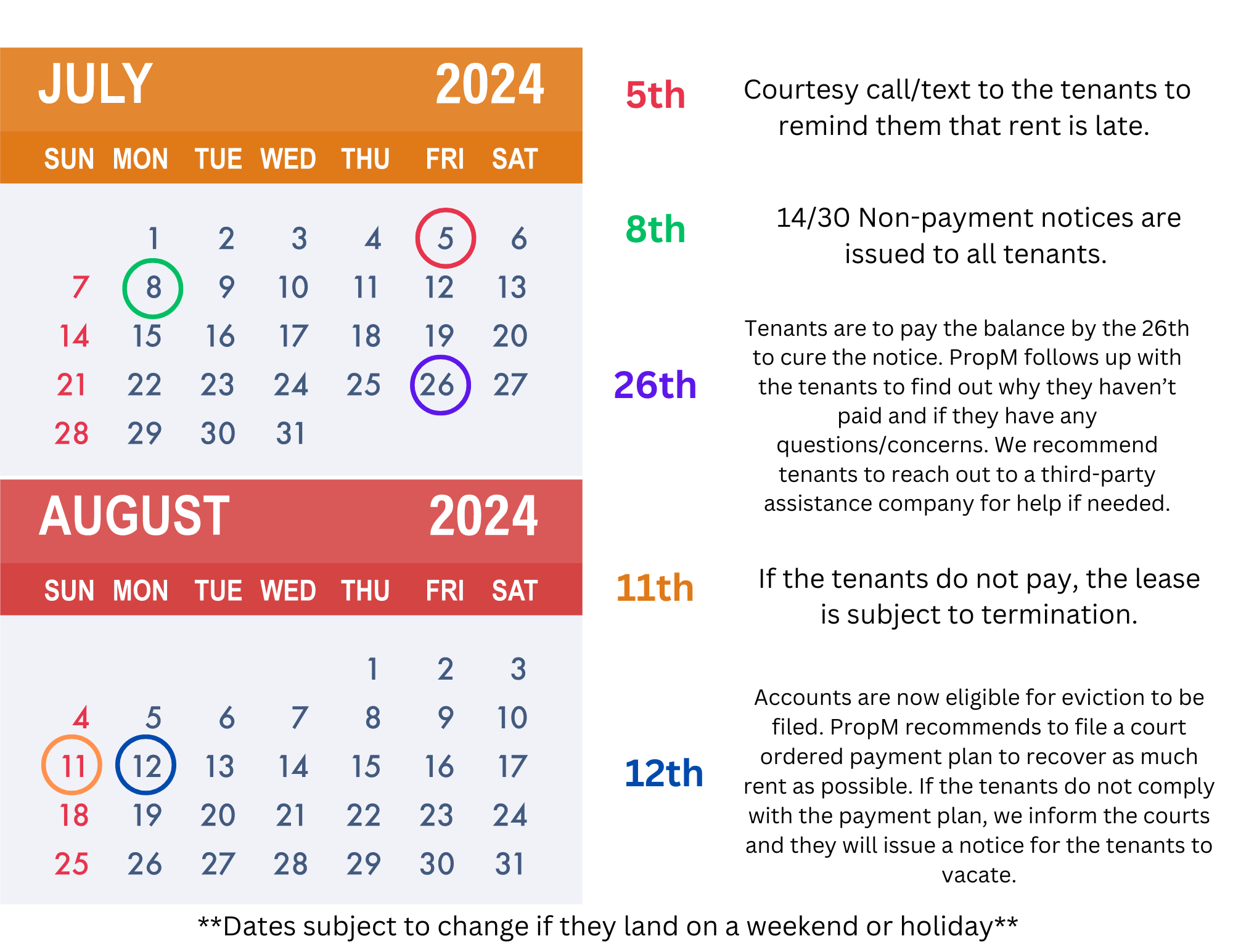

watch videotext answerIf your tenant isn't paying rent, don't panic—we've got you covered. When rent is late, we act fast.

First, we remind tenants when rent is due. A personal call and email go out if rent is past due. If rent is more than 7 days late, we issue a notice of termination. Next, we provide tenants with a list of third-party rental assistance companies. They have 14 days plus four for mailing to pay or 30 days plus 4 for mailing to vacate the property.

After 34 days, if the tenant hasn't paid, you, the property owner, get to decide: proceed with eviction or choose a court-ordered payment plan. We take the stress out of late rent with our proactive approach. You're never left in the dark; your investment is protected every step of the way.

-

Owner Portal 101

watch videotext answerHere's how your owner portal can help you today: With our owner portal, you can see your cash in, cash out, contributions, and distributions all in one place. Need to check your statements or end-of-year cash flow? It's all right here. Keep tabs on every transaction for your property, from inspections to tenant leases, even your 1099 documents.

Got multiple properties? No problem. Track them all with ease. Make owner contributions online and approve maintenance requests with just a few clicks. Your owner portal is your one-stop shop for managing your investments efficiently.

So, what are you waiting for? Unlock the power of your owner portal today and take charge of your property management like never before. Happy managing!

-

Troubleshooting Before Submitting A Maintenance Request

watch videotext answerThank you for submitting your maintenance request. We appreciate your promptness in notifying us of the issue. Before we dispatch a technician, we kindly ask that you attempt some troubleshooting steps that could potentially resolve the problem quickly and reduce the time you spend waiting for repairs. Here are a few tips to try:

Electrical Issues: Please check your circuit breakers, GFCI outlets, and light bulbs to ensure none have tripped or are burnt out.

HVAC/AC: Replace the air filter and batteries in the thermostat.

Clogged Drains: Attempt to resolve the clog using a plunger or a drain snake.

Please note that if we dispatch a technician and they find any of the above issues, including tenant-caused clogged drains, you may be charged for the repair.

For more detailed instructions and additional tips, please visit our website at Maintenance Quick Fixes. We appreciate your cooperation and understanding. Should these steps not resolve the issue, please let us know by emailing maintenance@propmhomes.com, and we will promptly dispatch a technician to assist you.

-

What Happens When Your Tenant Doesn’t Pay Rent & Won’t Leave

watch videotext answerWe have them move. 😊

-

Owner Selling within the City of Portland After 1st Year of Tenancy

watch videotext answerIf the property is located within the City of Portland/Milwaukie and tenants are after their first year of occupancy. Owner has to have one of the four qualifying reasons to terminate the lease with a 90 days notice.

- Owner is moving into home

- Owner is renovating the home and it will become inhabitable

- Owner is demolishing the home

- Owner has an accepted offer and the new owners intend to move in.

Relocation is due and payment must be paid no later than 45 days from move out date. Payment must be reported to Portland Housing Bureau

-

Owner Selling Outside of Portland/Milwaukie After 1st Year of Tenancy

watch videotext answerIf the property is not located within the City of Portland/Milwaukie and the tenants are after their first year a 90 days notice is required and owner has to have one of the four qualifying reasons to terminate the lease:

- Owner is moving into home

- Owner is renovating the home and it will become inhabitable

- Owner is demolishing the home

- Owner has an accepted offer and the new owners intend to move in.

Relocation of One Months Rent is due if the owner has ownership in more than 4 dwellings in the State of Oregon

-

Owner Selling Within Portland/Milwaukie During 1st Year of Tenancy

watch videotext answerIf the property is located within the City of Portland/Milwaukie and tenants are in their first year of occupancy, must provide the tenants with a 90 Days notice of non renewal. Relocation is due and payment must be reported to Portland Housing Bureau. Relocation payment is due no later than 45 days from move out date.

-

Owner Selling Outside Portland/Milwaukie During 1st Year of Tenancy

watch videotext answerIf the property is not located within the City of Portland/ Milwaukie and tenants are in their first year, a 30 days notice is required to the tenants. Relocation is not applicable.

-

Owner Selling; Property Vacant

watch videotext answerEver wonder what to do when your property is vacant? Let's break it down in under a minute. First things first, if your property is vacant, you need to give a 30-day notice of cancellation. This is super important to avoid any unexpected issues. Also, keep in mind there might be some cancellation charges due now.

After your tenants have moved out and the security deposit has been accounted for, here’s what happens next: all the funds you have on hand will be released to you, but it takes 45 days, so mark your calendar and be patient. Keeping these steps in mind will help you manage your property smoothly and avoid surprises.

Got questions? Drop them in the comments. Thanks for watching and happy property managing!

-

“Hold Harmless” Clause

watch videotext answerHi everyone! If you're a property owner, today we're going to explore something very important for you and your property manager: the value of including a hold harmless clause in your agreement. Understanding this can help you avoid many potential issues and save money, so let's dive right in.

First, what exactly is a hold harmless clause? This clause is all about managing risk. It allows you and your property manager to clearly outline responsibilities, ensuring smooth operations. This clause protects your property manager from issues that aren't directly their fault, like inherent property defects or injuries that happen on the property, unless they've been grossly negligent or intentionally at fault.

So, why is this important? It provides your manager with legal protection. It essentially shields them from being sued for most problems related to your property. It also helps in clearly defining responsibilities. It lays out in black and white what you, the owner, are responsible for, and what falls under your manager's duties. This clarity is crucial in preventing misunderstandings and ensuring smooth operations.

Additionally, it discourages false complaints by imposing penalties for those, protecting your manager's reputation and ensuring they operate in a professional environment. Moreover, this clause promotes open dialogue to resolve issues, which is beneficial for both you and your manager. When both parties feel secure and supported, cooperation is better, communication is fluid, and the overall management process runs more smoothly.

So there you have it—the hold harmless clause isn't just legal jargon. It's a fundamental part of your property management agreement that protects both you and your manager. It ensures that the focus remains on maximizing the potential of your property. Make sure to discuss this with your legal advisor and property manager to tailor the best agreement for your situation. Thanks for tuning in, and I'll see you in the next one.

-

Termination: Selling When The Home Is Occupied By A Tenant

watch videotext answerEver wondered how selling your home could be as easy as pie? With PropM, it's just that. Selling your home can seem like a mountain of paperwork and legalities, but with PropM, it’s a walk in the park. Here’s how it goes down.

First things first, let's talk termination. If your property's occupied and you're ready to sell, you just need to drop us an email to kick things off. Yep, that’s right, just an email. Break time point: once we receive your notice, the ball starts rolling.

We stay in the loop with you until the sale crosses the finish line. And it doesn’t end there. You tell us who gets the keys, the security deposit, and all those important tenant details. And yes, you guessed it, all in writing.

Now here's a little cherry on top: we safeguard your funds for 60 days post-sale. Why, you ask? Just making sure all those final bills are paid and sorted on your behalf. After that, every penny goes right back to you.

Selling your home with PropM? It’s as easy as sending an email, and we handle the rest, making sure everything is squared away neatly. Ready to get started?

-

Termination: Selling When The Home Is Vacant

watch videotext answerThinking about selling your rental property? Here’s how you can make it happen smoothly and swiftly with PropM. Selling your home doesn't have to be a headache. With PropM, the process is straightforward and stress-free.

If you’re ready to sell, the first step is simple: just send us your termination notice in writing. An email will do just fine. Once we receive your notice, we’ll stop all advertising and take down any rental signs. This signals that your property is moving from the rental market to the sales block.

Next, either you or an agent you’ve authorized in writing can swing by to pick up the keys. It’s that easy. Meanwhile, we’ll do a quick check for any outstanding invoices or dues. And don’t worry about any financial loose ends; we hold on to funds for 60 days after the termination to ensure all invoices are settled. After this period, we return the remaining funds to you, closing your account cleanly and completely.

With PropM, selling your home is as straightforward as renting it out was. Let’s make your transition from landlord to seller smooth and successful.

-

Tenant: Rental Criteria

watch videotext answer -

How Will You Market My Property?

watch videotext answerLandlords are no longer allowed to turn down prospective renters simply because they receive rent subsidies from the federal Section 8 program. Of course prospective tenants do have to meet rental criteria. -

How Will You Market My Property?

watch videotext answerWe will advertise your home on all the standard real estate websites, Zillow, Trulia, Hot Pads and many you have never heard of like Cribs, Zumper, Lovely and more. We take it even further by offering a social media package which broadens the reach to include Tik Tok, Instagram, Facebook, LinkedIn, Twitter and more. -

Do You Collect the First and Last Month's Rent?

watch videotext answerOnce the tenant is approved, we move forward and collect a security deposit equal to one full month's rent, as well as a pet deposit and any other fees if applicable. Regardless of the actual move in date, the first month's rent is always due in full prior to move in. This ensures the initial first month rent is paid in full prior to picking up the keys. The prorated rent will be due on the 1st of the following month. -

How am I Protected if the Tenant Damages the Property?

watch videotext answerFirst we require all tenants to have current renters insurance. We also collect a Security Deposit to help offset any tenant damages above the beyond normal wear and tear. Secondly, we do a move-in inspection, along with 360 degree video, documenting conditions at time of move-in, moveout. If the tenants owe more than their security deposits cover, we send them an invoice for the amount due. If they don’t pay the bill, we turn them over to a reputable collections company. -

How Long Will it Take to Find a Tenant?

watch videotext answerUsually about one to three weeks. Ultimately you are in control, if you tell us to get rented in a week, we can, the price would be reduced, but we certainly can do it. We prefer to charge market rents versus trying to get someone in quickly, but we do understand sometimes it's important to get someone in sooner at a lower price than wait. Ultimately, your call as the property owner. -

I don’t Want Pets, is That Ok?

watch videotext answerNearly 80% of families have Pets and most of the ones we know love their pets. If you are absolutely sure about no Pets, then of course we will not show or allow any tenants with Pets. Keep in mind you cannot discriminate against a 2 year old child who will do much more damage than a pet. We strongly encourage you to accept pets, and we realize there will be situations where you just prefer not pets. A pet you get to charge additional Pet Rent each month, plus you have an increased security deposit. -

Should I Allow Pets in My Rental Property?

watch videotext answerLet's talk about pet policy. A lot of owners, especially first-time owners or those new to being landlords—whether by design or because they can't sell their property—are concerned about pets. Now, I own several properties and I allow pets in all of my properties for a few different reasons. I think people who own pets, first of all, come home every night mostly to take care of their pets, which is nice. You know they're going to be in there, occupying the property, keeping it warm, most likely paying rent, etc.

Now, you've got to be careful, of course, about what type of pets you allow. We have restricted breeds, so unfortunately, as much as I'm an animal lover, pit bulls and some other dangerous breeds, which we have listed on our website, we don't allow. And that's really just for the protection of everybody, including the tenant that owns the pet. You don't want them to have their dog do something, for example, and just cause big trouble for them and everybody else. So, we definitely restrict the types of pets you allow.

However, I do allow pets in all my properties. Yes, they pay a pet deposit and/or pet rent. With good documentation, you should have no troubles. The tenant needs to clean the property up, of course, if the dog or pet makes any messes or causes damage. Absolutely, they're responsible for taking care of that, whether it’s through their security deposit or even courts if the damage is greater than the security deposit. We definitely have some ideas and tips on how to help you with pet policy and getting the proper coverage, so in case there is damage, you're protected. However, I encourage you to allow pets. There's a lot of people, a lot of great families with pets, and if you have a great home, they will take care of it, and you will be just fine. Thank you. Will you take on my property if I live in ½ of it?

-

Can you help me understand Support and Service animals?

watch videotext answerEvery landlord is required by the Fair Housing Act and the Americans with Disabilities Act to allow service and support animals into a property, even if pets are not allowed. However when you have tenants moving in with pets, you can charge pet rent and higher deposits. -

What do I need to do to get my house ready to rent? And how can I get the highest rent price?

watch videotext answerTo get a quality tenant and maximize your rental income, your home needs to be professionally cleaned, carpets professionally cleaned (or replaced) and all necessary maintenance work completed. It’s important to note we strongly encourage and we help facilitate the professional cleaning and maintenance to confirm all the little things are cleaned and working to perfection. If your home's interior has not been painted in years, you may want to consider having a full paint completed, it will absolutely increase the monthly rent. It’s not required, however, everyone loves a fresh new coat of paint. Window coverings are always a good question. Do I leave them or do I take them? For the well-being of your home, you don’t want to take them down and have someone else put different coverings up. It causes unnecessary wear and tear on your home. Remember, the better the condition of your home, the better quality tenant and higher rent you will receive. All personal belongings of yours will need to be removed from the home, unless of course, they are permanent. -

What happens if the tenant does not pay rent on time?

watch videotext answerThis is a rare occurrence these days with our proactive approach. We remind each tenant when rent is due, each tenant receives a personal call and email once rent is past due. If rent is more than 7 days past due, we issue a Notice of Termination. We also provide all our tenants with a list of 3rd Party Rental Assistance Companies. Tenant has 10+4 (days for mailing) to pay or 30 + 4 (days for mailing) to vacate the property. After the 34 days, if the tenant has not paid, the property owner will have the choice to proceed with Eviction. The property owner can choose for the tenants to have a court ordered payment plan or be ordered to vacate the property. -

When are funds released to me?

watch videotext answerWe are the fastest paying company in the business. For all rent paid and cleared, we complete the first distribution on the 10th and every Thursday thereafter. We do not process distributions between the 1st and the 9th. If distribution falls on a banking holiday or weekend, funds will be released on the next business day. *Please allow 7-10 for processing of late rents -

What happens if my tenant vacates and owes me money?

watch videotext answerThe tenants have 14 days to remit payment after the security deposit has been processed. If the tenants fail to pay their past due balance, they can be sent to Collections or the Property Owner can pursue the debt through Small Claims Court. Once the tenant has been turned to collections, PropM is no longer able to speak with the tenants. The collection agency keeps 40% of collected funds from the tenants. Any collected funds from the agency will be sent to PropM and then released to the owner. PropM only sends accounts to collections with the owners written approval due to the agency keeping 40% of collected funds. -

Will I be called in the middle of the night?

watch videotext answerNo, that’s why you hired us to relieve you of that stress. We handle all emergencies 24 hours a day. We are one of the only companies that answers all calls with a live voice 24/7 to ensure the best possible customer service and availability. We always authorize all work to be done that falls under your maintenance limit, so there will never be surprises on your homeowner’s distribution. If there is an emergency we will dispatch a vendor to resolve immediately and inform you of the repairs needed. -

Are you licensed?

watch videotext answerYes, we carry an Oregon Principal Brokers license and Oregon Property Management license. -

Why do we require to be added as additionally insured?

watch videotext answerOne main reason is the Property Manager takes on risk and liability as if they were a homeowner. The typical property management company carries general and professional liability. This insurance does not offer protection in regards to matters concerning the home itself. Essentially, the property manager assumes all the liability a homeowner does, however the insurance policies do not offer the same type of protection. This potentially leaves the property manager vulnerable to issues arising from the property itself, such as someone injuring themselves at the property, fire, water, burglary, etc. Ultimately it is a wise idea for the homeowner to add their property manager as additionally insured. From the owners standpoint, listing the property manager is required, and as an additionally insured it helps make the claims or litigation process easier. When one policy extends to both parties, they are able to present a unified defense, with one insurance company representing both. It not only streamlines the process, it reduces costs. -

Do you keep me updated when my home is being advertised?

watch videotext answerWe keep you updated all along the way. We let you know each time we receive interest on your home, we update when we have showings and weekly we report to you the past weeks efforts, inquiries etc. -

How do you set the rental price of my home?

watch videotext answerWe use a variety of analytics to help determine the current market rents, including actual rents from the many homes we manage, and whether rents are trending up or down, We also take into account the type of property, type of owner, as some like to have the home rented right away, and others are willing to wait for top dollar. We can customize based on each owner's goals. -

Why is my property manager asking to be added as additionally insured?

watch videotext answerOne main reason is the Property Manager takes on risk and liability as if they were a homeowner. The typical property management company carries general and professional liability. This insurance does not offer protection in regards to matters concerning the home itself. Essentially, the property manager assumes all the liability a homeowner does, however the insurance policies do not offer the same type of protection. This potentially leaves the property manager vulnerable to issues arising from the property itself, such as someone injuring themselves at the property, fire, water, burglary, etc. Ultimately it is a wise idea for the homeowner to add their property manager as additionally insured. -

Can I reach you after hours?

watch videotext answerYes, we are the only company who is open 365 days a year, and answers our telephone calls 24/7. We have no voicemail so you will always talk with a live human. 😊 -

Can you put the money directly into my account?

watch videotext answerYes, definitely. We are highly electronic. We are also the fastest paying company! We deposit funds weekly via ACH. -

Can I use my own contractor?

watch videotext answerYes, kind of. Depending on the situation. We are finding it much better to have all work coordinated through PropM, Inc as we do this daily. Most often when owners use their contractor the work is not up to par for a variety of reasons, the process is slow. We prefer to handle all the work as we do not upcharge on third party vendor work orders. -

What happens if I have to evict a tenant?

watch videotext answerThe Eviction process is actually pretty straight forward, please call us if you have specific questions. We offer an Eviction Safeguard which we will pay for the cost of an eviction, up until a jury trial. No attorneys fees will be paid via Eviction Safeguard. -

Do I get to see the lease or sign it?

watch videotext answerYou can see the lease. We have a sample right here: Sample lease. In our agreement you are not allowed to talk with the tenant as it always confuses things. Yes, you can see the lease, however we don’t want you in contact with the tenant for many reasons, mainly for both of our protection. Of course we make the lease available to banks, etc when requested. -

Do you sell real estate too?

watch videotext answerNo, we do not. We specialize in providing 24/7/365 service to our property management clients. -

How and when do I get my checks?

watch videotext answerWe only deposit via ACH into your account. We are paperless and do most things electronically. -

How is collection handled?

watch videotext answerFirst, we have a very clear lease when rent is due, when it is late. Due on the 1st, late on the 5th. All tenants get reminder emails on the last day of the month. Each tenant who has not paid rent on the 5th is contacted in writing. We have a very high industry-leading on-time rent collection record. Mainly because we are here 24/7 to offer support and service, which really helps with on time rent collection. -

How long of lease do you sign?

watch videotext answerWe usually sign 12 month leases. There are other options available upon request. -

Who is responsible for Tenant Damages?

watch videotext answerTenant Damages Disclaimer

PropM, Inc. shall not be held financially or legally responsible for any damage caused by tenants, occupants, guests, or third parties to the property during or after the tenancy, regardless of screening methods, lease enforcement, or management oversight. While PropM, Inc. takes all reasonable steps to mitigate risk—including tenant screening, inspections, and lease enforcement—ultimate liability for damages lies with the property owner.

Just to be clear: PropM, Inc. is not responsible for tenant damages.

No property manager—no matter how thorough—can prevent all tenant damage. Our job is to screen, enforce, and document, but the risk of loss remains with the property owner. You should be protected through a strong security deposit and appropriate insurance (including landlord policies and possibly a home warranty). -

How often do you inspect the property?

watch videotext answerWe inspect the property multiple times. We first inspect the property before we do any work, this is the initial property inspection. Once the home is ready for move in, after all work is completed and the home is cleaned, we do a move in video to document the condition of the home. 180 days after move-in, we have an automatic 6 month inspection scheduled to check for leaks, smoking, pets, extra occupants and more. When the tenant moves out, we will perform a move out inspection, to document the condition the tenants left the home in. -

Do I have to accept kids?

watch videotext answerYes, we do. We have to abide by Fair Housing laws, which does not allow you to discriminate against children. -

How much security deposit do you charge?

watch videotext answerWe usually charge a security deposit equal to one month's rent. If there are pets involved we increase the security deposit by $500, this allows us to use the entire security deposit for the pet damage, which you would not be able to do if you charged a pet deposit only. -

What is the difference between Normal Wear and Tear vs. Damage?

watch videotext answerType of Material

Average Useful Life

Normal Wear and Tear

(Landlord’s Responsibility)Tenant Damage

(Tenant’s Responsibility)Carpet

5 years

Gently worn carpets that show some worn patches but no holes or stains

Pet caused damage such as heavily stained carpets and ripped carpeting

Hardwood Flooring

25 years

Fading of flooring due to sunlight exposure

Deeply scratched hardwood floors or pieces of the hardwood missing

Tile Flooring

25 years

Dirty grout surrounding the tiles

Broken or chipped tiles or missing tiles

Windows

20 years

Lightly scratched glass and worn, loose hardware

Broken glass, ripped screens, broken window hardware

Countertops

20+ years

Scratches and light watermarks

Chipped countertops, burnt areas, and/or multiple stains

Walls

Lifetime

Cracks in the walls caused by settling

Holes in the walls, damage from hanging pictures

Paint

3 years

Fading paint from sunlight and minor scuffing from daily use

Paint that has been scribbled on, unauthorized paint colors

For a better understanding of the difference between the two (and when you can deduct the tenant’s deposit), let’s take a look at the two most common examples, which are normal wear and tear vs damaged carpet and normal wear and tear vs damaged paint.

Normal Wear and Tear vs Damaged Carpet

If the carpet has been in place for 5 years or longer, it’s the landlord’s responsibility to replace it, since that is the length of the carpet’s useful life. If the carpet has light sun damage or is showing signs of wear, that is normal wear and tear and the landlord cannot blame the tenant.

It’s the landlord’s responsibility to keep the property free of hazards. So, if the carpet has worn out over the years and become a trip hazard, it should be immediately replaced and paid for by the landlord. But, if the carpet has been ripped or has excessive fraying, it’s the tenant’s fault and the cost to replace it can be deducted from the tenant’s security deposit.

Further, if the carpet is stained either by a pet or spilling food, wine, dirt, and more, it’s considered tenant-caused damage and can also be deducted from the security deposit. State laws vary on landlord tenant laws regarding security deposits but generally, the landlord needs to get a repair quote from a licensed contractor and send the tenant an itemized list of the damage along with the check for the remainder of the security deposit.

Normal Wear and Tear vs Damaged Paint

Peeling paint, sun damage or a small number of scuffs are considered normal wear and tear and the landlord should touch them up between tenants. Ceiling paint usually lasts longer since no one is constantly touching the ceiling. Ceiling paint should be touched up when a leak occurs or on an as-needed basis.

If the paint has holes in it, excessive scuff marks or other marks such as drawings or scribbles, it is considered damage caused by a tenant. In this case, the cost to fix the damage and paint the walls will be deducted from the tenant’s security deposit. You can do this by getting a quote from a licensed contractor and sending the tenant an itemized list of the damage, along with the check for the rest of their security deposit.

“The easiest way to discern between wear and tear and tenant caused damage is to think of wear and tear as any damage that’s caused by natural forces or damage that’s caused by daily use. Tenant caused damage should be thought of as damage requiring more than routine maintenance to repair. Obviously, this doesn’t include things like a leaky pipe or things that would happen to the property regardless of who the tenant was.”

-

How soon can you start managing my property?

watch videotext answerToday! We move fast. We can send you an agreement today, you sign today, and your home could be posted today! Of course if your home is not ready, or needs a professional photo shoot, that can be scheduled usually within 48 hours. -

What type of properties do you manage?

watch videotext answerWe manage all types. Single Family & Multi-Family. Homes, Condo’s, Individual Apartments, Apartment Complexes, Food Carts and more. -

What type of reports do I get and how often?

watch videotext answerYou get a Owners Statement each month on the day of distribution. For us we distribute funds on the 10th of each month and each week after. You have many reports to choose from, from Cash Flow Report, Profit & Loss, among many others. -

Who holds the tenant security deposit?

watch videotext answerWe hold the tenants' security deposit in a non-interest bearing account as required by Oregon law. This also allows us to properly and accurately process the security deposit. -

What happens when we terminate for whatever reason?

watch videotext answerThere are many reasons for termination, most common is selling the home or moving back in. In either case, as when you hired us, you or we prepared your home to be rent ready. As you terminate us, it will be your responsibility to prepare you home for the next round, whether it be your selling or moving back in. It will be the owners responsibility to get the home prepared for the next phase. -

Will you take on my property if I live in ½ of it?

watch video -

Indemnifying Property Owner

watch videotext answerHey property owners, are you worried about potential damages and legal woes from renting out your properties? Well, let's dive into how lease indemnification can be your invisible shield, protecting you from unexpected financial hits. Firstly, let’s talk reimbursement for damages. Imagine a scenario where a tenant accidentally overflows the sink and the next thing you know, water is dripping into the apartment below—not fun, right? Under a lease agreement with a solid indemnification clause, your tenant is responsible for covering the cost of all these repairs. That's right, instead of you having to dip into your savings, the indemnification clause ensures the tenant pays up for their negligence or improper use. This isn’t just about water damage; it applies to any property damage caused by the tenant, their family, or even their guests.

Now, moving on to confidentiality, this part is crucial in maintaining a professional relationship and trust. Both you and the tenant agree that whatever is written in the lease stays between you two—no airing dirty laundry. This means no sharing the details of your agreement with anyone else without explicit permission. It’s like Vegas: what happens in the lease, stays in the lease. And yes, that includes making sure neither party makes disparaging remarks about the other, keeping things professional and discreet, which only adds to a smoother landlord-tenant relationship. Lastly, the big one: indemnification against liabilities. This clause is your superhero cape. It says that if your tenant does something that ends up hurting someone or damaging someone else's property, you’re not the one who’s going to be held accountable. For example, if a tenant’s faulty DIY electrical work leads to an injury, the clause ensures that you, the landlord, are held harmless. It’s the tenant’s responsibility to handle the legal repercussions and associated costs. This part of the clause also covers compliance with laws, ensuring that tenants can’t feign ignorance if they break a rule and try to drag you into it.

In summary, having a lease indemnification clause means that you, the property owner, get to protect your investment and peace of mind. You ensure that tenants are accountable for their actions, financially and legally, safeguarding you from unexpected costs and legal headaches. So next time you’re drafting or revising a lease, remember the power of indemnification—it’s a property owner’s best friend. Thanks for tuning in, and make sure your next lease agreement is your shield against the unpredictabilities of property rental. Stay smart, stay protected.

-

When A Tenant Cancels Their Lease Before Moving In!

watch videotext answerPropM here. This is what happens when a tenant cancels their lease before moving in. No worries, here's our simple plan. First, we give the tenant their security deposit back. Yes, they do get that back, but they're still responsible for one month's rent—fair's fair, right?

Now, our management fee? We keep that, but you get the rest of the money. Good news: we won't charge you a leasing fee for a canceled tenant. We start advertising immediately to fill the spot ASAP.

So, in a nutshell: tenant cancels, deposit back, one month's rent due, you keep the rest, no leasing fee, and we're back on the hunt for the next great tenant. Simple and straightforward. Now you know. Catch you in the next video!

-

Understanding Tenant Rent Proration

watch videotext answerWelcome to PropM! In this video, we'll explain how rent proration works to ensure you only pay for the days you occupy the property when you move in mid-month. If you're new to renting or moving in partway through the month, you probably have questions about how your first month's rent is calculated. Let's break it down. Rent proration ensures that you only pay for the days you occupy the property, starting from your move-in date. Here's how it works: We calculate daily rent based on a 30-day month. For a property renting at $2,000 per month, this makes each day's rent approximately $66.67.

- Example for a 28-day month: If you move in on the 5th, you don't pay for the first 4 days. Instead, you pay for the remaining 24 days, which totals to $1,600.

- Example for a 30-day month: Moving in on the 5th means you pay for the next 26 days, adding up to $1,733.33.

- Example for a 31-day month: You're responsible for 27 days, costing $1,800.

Understanding rent proration is crucial for ensuring smooth transitions between tenants. It helps you maintain steady income while being fair to new tenants moving in mid-month. Rent proration benefits both you and your tenants as a PropM property owner.

Got questions? Connect with our team at PropM for more details on how rent proration can benefit your property management. Contact PropM today if you need more info on how this helps manage your property smoothly.

-

Delinquency Process- Unpaid Rent

watch videotext answer